Amortization Schedule

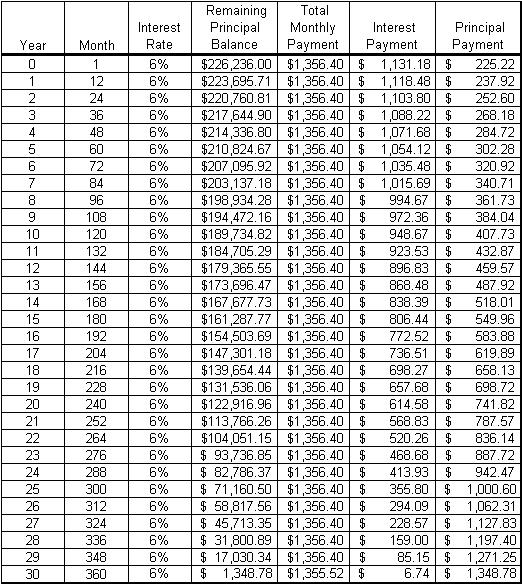

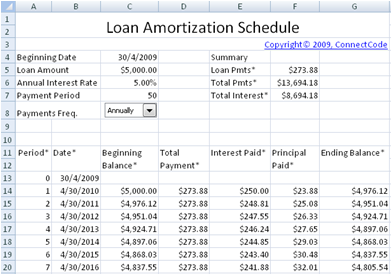

To make your own amortization schedule, you have to have your

interest rate, monthly payment and the remaining principal value. You

take your interest rate and multiply it by the remaining principal

value. You take this number and divide it by 12 as you are using a

yearly interest rate, the result is the interest portion of the monthly

payment. Subtract the interest portion from the total monthly payment to

get the principal portion. Subtract the principal portion from the

remaining principal value and you begin the process over again until you

have no principal remaining.Initially, the majority of your monthly mortgage payment goes towards

interest. In fact, the majority of your payment doesn’t start going

towards principal until year 19! The total amount paid in interest and

principal after 30 years is $488,303.12. $262,067.12 went towards

interest and $226,236.00 went towards principal. If you do not make

extra payments towards principal and pay according to the amortization

schedule you end up paying 2.16 times the original borrowed value.

Amortization Schedule

Amortization Schedule

Amortization Schedule

Amortization Schedule

Amortization Schedule

Amortization Schedule

Amortization Schedule

Amortization Schedule

No comments:

Post a Comment